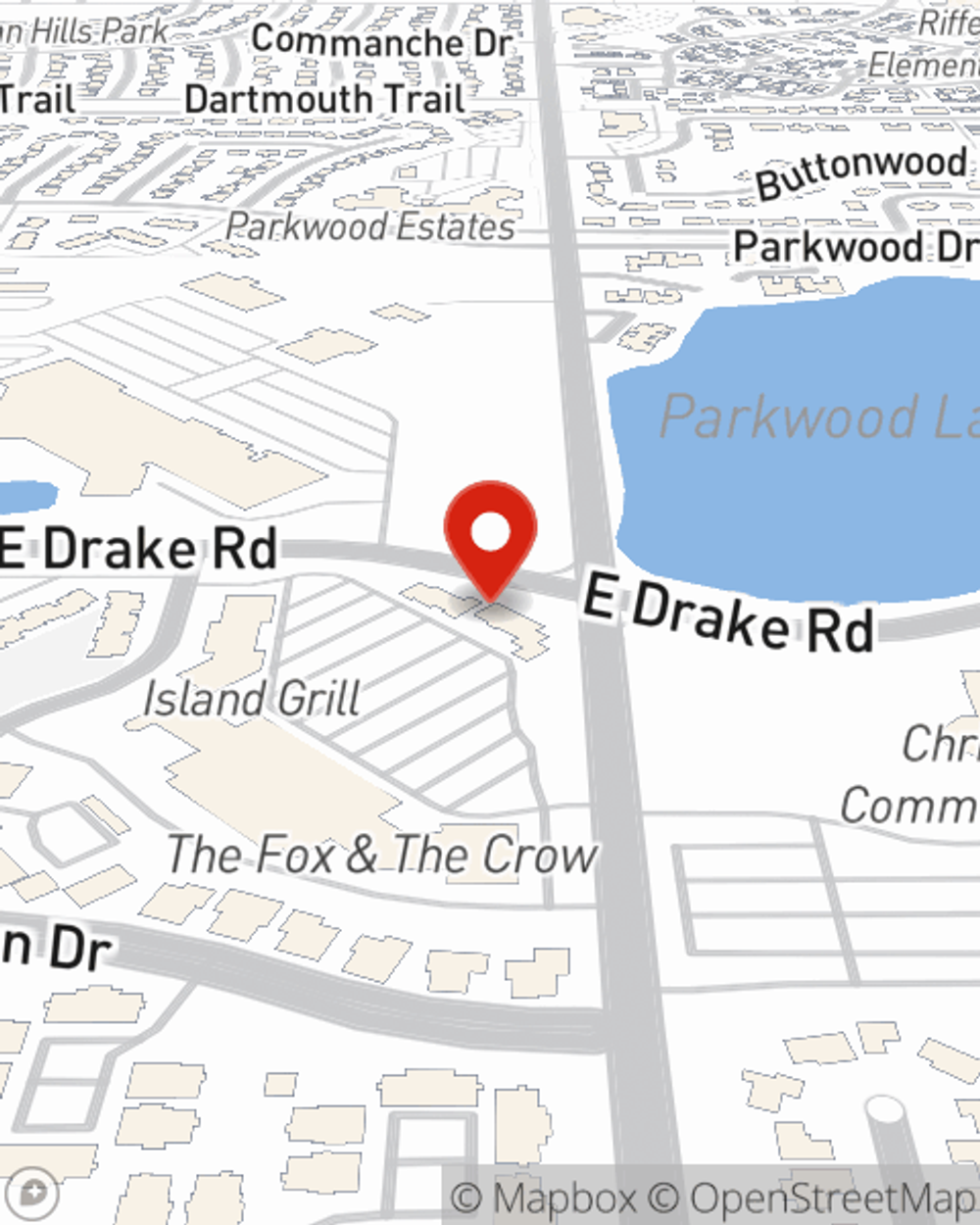

Homeowners Insurance in and around Fort Collins

Looking for homeowners insurance in Fort Collins?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Fort Collins

- Timnath

- Wellington

- Larimer County

- Loveland

- Severance

- Windsor

- Greeley

- Weld County

Home Sweet Home Starts With State Farm

You want your home to be a place of refuge when you're tired from another long day. That doesn't happen when you're worrying about your kids coloring on the walls again, and especially if your home isn't covered. That's why you need us at State Farm, so all you have to worry about is the first part.

Looking for homeowners insurance in Fort Collins?

The key to great homeowners insurance.

Safeguard Your Greatest Asset

Marinda Simpson can walk you through the whole coverage process, step by step. You can have a straightforward experience to get coverage options for everything that’s meaningful to you. We’re talking about more than just protection for your swing sets, electronics and linens. Protect your family keepsakes—like pictures and mementos. Protect your hobbies and interests—like videogame systems and tools. And Agent Marinda Simpson can share more information about State Farm’s great savings and coverage options. There are savings if you choose a higher deductible or have home security devices, and there are plenty of policy inclusions, such as liability insurance to protect you from covered claims and legal suits.

It's always the right move to get coverage with State Farm's homeowners insurance. Then, you won't have to worry about the unexpected fire damage to your property. Contact Marinda Simpson today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Marinda at (970) 223-7800 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.

How to protect your digital footprint

How to protect your digital footprint

Reduce your digital footprint, when visiting a website or entering info online, by minimizing the data you leave behind so that it’s not misused by others.

Marinda Simpson

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.

How to protect your digital footprint

How to protect your digital footprint

Reduce your digital footprint, when visiting a website or entering info online, by minimizing the data you leave behind so that it’s not misused by others.